Are you a frequent shopper at Kohl’s? Kohl’s offers a credit card program that provides customers with various benefits and convenient ways to manage their accounts. The MyKohlsCard Portal allows cardholders to access their account information, make payments, take advantage of exclusive offers, and save 35%.

Being a Cardeholder, Mykohlscard.com Login Page will help you to access Kohl’s Credit Card payment login account, pay bills to ypur shoping, make payments, and reach eecustomer services.

What is MyKohlsCard?

Capital One offers Kohl’s Credit Card. Kohl’s accepts this retail credit card online and in-store. A lot of customers like these cards because it has no annual fees. Savings are a major benefit of the My Kohl’s Card. Shopping with your card can save for the future. Free delivery is another card feature. These savings can add up over time, allowing customers to buy more or put money aside.

Mykohlscard website is available 24/7, making it easy for cardholders to check account details, make payments, and update personal information. This online access removes the need to visit physical locations or speak with representatives for basic account management tasks.

The card comes with a high variable APR, the interest rate can change over time and may be higher than other credit cards. However, cardholders can avoid interest charges by paying their balance in full each month.

| Name | Mykohlscard |

| Webiste | www.mykohlscard.com |

| Registration | Required |

| Issued By | Capital One |

| Country | USA |

| Services | Retail credit cards |

| Rewards & Discounts | Yes |

| Also Known | My Kohls Charge Card |

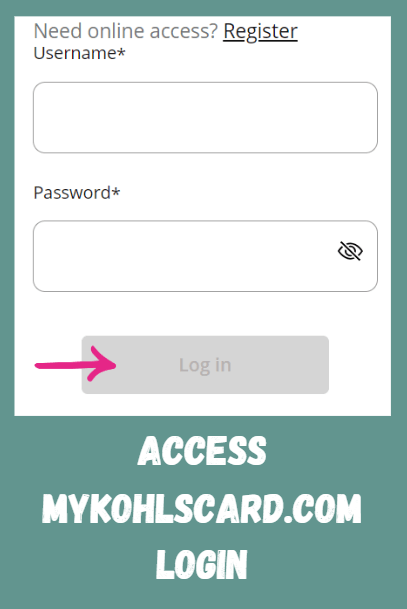

Access Mykohlscard.com Login Portal

To access the MyKohlsCard.com login portal, follow these steps:

- Visit the Website: Open your web browser and go to MyKohlsCard.com Login Page.

- Enter Your Credentials:

- Username: Enter your Kohl’s Credit Card account username.

- Password: Enter your password. If you don’t remember your password, use the “Forgot Username or Password” option to reset it.

- Log In: Click the “Sign In” or “Log In” button.

- Access Your Account: Once logged in, you can view your account details, make payments, check your balance, and manage your card.

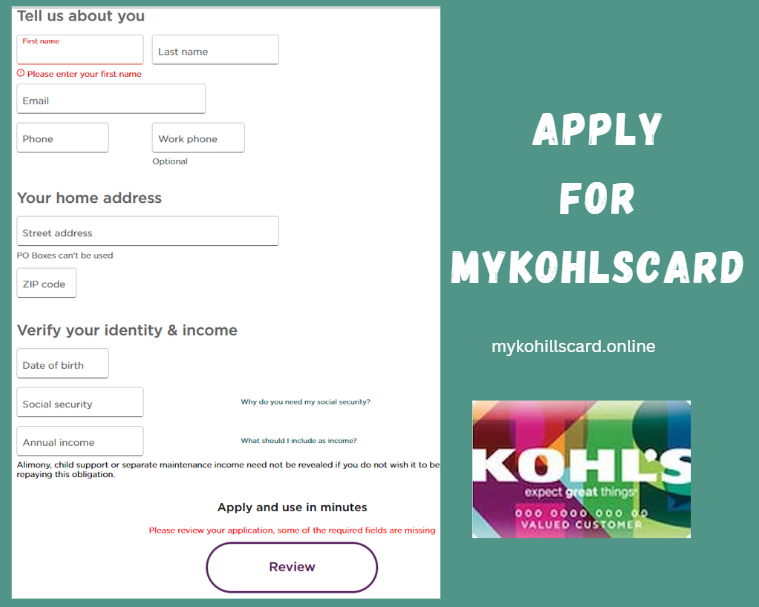

Apply For Kohl’s Credit Card

Applying for a Kohl’s Credit Card as a first-time user is a simple process. Here’s a step-by-step guide:

1. Visit the Application Page: Go to the Kohl’s Credit Card Application Page.

2. Start the Application: Click on the option to apply for a Kohl’s Credit Card. This will take you to the application form.

3. Complete the Application Form:

- Personal Details: Enter your name, address, and contact information.

- Financial Information: Provide your income and employment details. This helps Kohl’s assess your creditworthiness.

- Social Security Number: Enter your SSN for identity verification.

- Identification: Provide a government-issued ID, if required.

4. Review Terms and Conditions: Carefully read the Kohl’s Credit Card Apply terms and conditions online. This includes interest rates, fees, and rewards programs.

5. Submit the Application: After filling out the form, review all the details for accuracy. Click the “Submit” button to send your application for review.

6. Receive Your Decision: Kohl’s will process your application and provide you with a decision. You may receive an immediate response or it might take a few days. If approved, you’ll receive your Kohl’s Credit Card in the mail.

Note: Once you submit your application, you will receive a decision within minutes. Your new card will be mailed within 7-10 business days if approved.

Credit Score: A good to excellent credit score can improve your chances of approval.

Pre-Approval Offers: Sometimes Kohl’s sends out pre-approval offers via mail or email, which can simplify the application process.

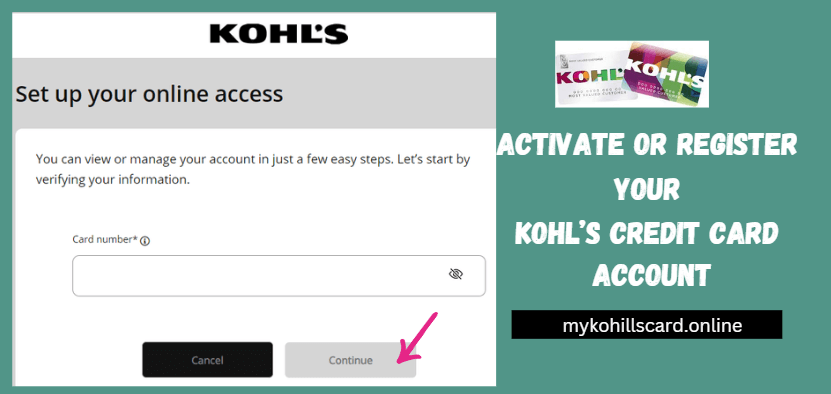

My Kohls Card Online Registration – mykohlscard.com/activate

To activate or register your Kohl’s Credit Card account online, follow these steps:

- Open your web browser and go to MyKohlsCard.com Registration Page.

- On the homepage, locate “Register” or “Activate.” This is typically found near the login area or in the navigation menu.

- You will be prompted to enter some personal and account details. This usually includes:

- Account Number: 12-digit Kohl’s credit card number

- Social Security Number (SSN): The last four digits of your SSN for identity verification.

- Date of Birth: Your date of birth to confirm your identity.

- Follow the prompts to create a username and password. Choose a strong password that combines letters, numbers, and symbols to ensure security.

- Double-check the information you’ve entered for accuracy. This ensures a smooth registration process.

- Click the “Submit” or “Register” button to complete the process. You may receive a confirmation message or email.

Reset MyKohlsCard.com Login Credentials

Recover Your Kohl’s Card Online Username

- Visit the Kohl’s Card website.

- Click the “Forgot Username” option.

- Enter your 12-digit Kohl’s credit card number.

- Provide your last name, birth date, and ZIP code.

- Type the security phrase shown on the screen.

- Click “Continue”.

- Follow the prompts to get your my kohl’s charge username.

Reset Your Kohl’s Card Password

- Go to the mykohlscard.com login website.

- Click on the “Forgot password”.

- Enter your username (not your email address).

- Type in the last four digits of your Social Security Number.

- Click “Continue”.

- Follow the on-screen steps to create a new password.

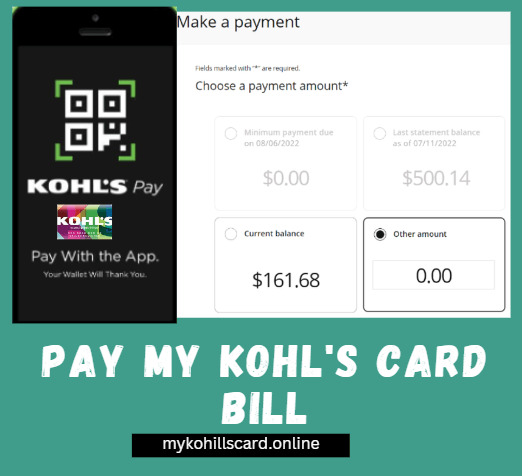

Pay Your Kohl’s Credit Card Bill

Paying your Kohl’s Credit Card bill can be done through various methods. Here’s a guide on how to make a Mykohlscard pay bill payment:

1. Online Payment:

- Go to MyKohlsCard.com.

- Enter your username and password to access your account.

- Once logged in, find the payment section of your account dashboard.

- Enter the amount you wish to pay, select your payment method (e.g., bank account for ACH payment), and follow the prompts to complete the payment.

- Review the payment details and submit. You’ll receive a confirmation of your payment.

2. Mobile App Payment:

- Open the Kohl’s mobile app and log in with your Kohl’s Credit Card account credentials.

- Navigate to the payment section in the app.

- Enter the payment amount and choose your payment method.

- Confirm the payment details and submit.

3. Mail Payment:

- Write a check or money order for the amount you wish to pay.

- Include the payment coupon or stub from your billing statement.

- Mailing Address: Kohl’s Credit Card PO Box 2983 Milwaukee, WI 53201-2983

4. Pay Bill Via Phone:

- Contact Kohl’s Credit Card customer service at 1-800-564-5740.

- Use the automated system or speak with a representative to make your payment.

- Provide your bank account details or a credit/debit card number to complete the payment.

5. In-Store Payment:

- Visit any Kohl’s store location.

- Provide your Kohl’s Credit Card and the payment amount to the cashier.

- You can pay with cash, check, or a debit/credit card.

Benefits of Having a My Kohl’s Card

Keeping track of card activity is simple. Kohl’s often has special sales and discounts for cardholders. These deals can save money on purchases. The card’s website is open all day, every day. This means users can manage their accounts whenever they want.

- 24/7 account access

- Online bill payment

- Credit limit increase requests

- Paperless statements

- Transaction monitoring

- Exclusive discounts

Advantages and Rewards for Most Valuable Customers (MVCs)

Kohl’s offers special perks for its Most Valuable Customers (MVCs). These elite shoppers enjoy exclusive deals and early sale alerts. New cardholders can earn a $15 Kohl’s Cash bonus when opening an account.

MVC status comes with unique benefits:

- Special coupons

- Advance sale notifications

- Exclusive member-only offers

The Kohl’s Card has no annual fee, but it does have a variable APR. Its rewards program can be complex. This card may not suit all shopping habits.

Cardholders earn Kohl’s Cash with each purchase. This reward applies to future buys in-store or online.

To become an MVC, shoppers must meet spending requirements. Elite status unlocks enhanced perks and savings opportunities. The card’s high interest rate is important to consider before applying.

About Kohls

The Kohl’s company was founded in Wisconsin in 1962 and is still active today. Except for Hawaii, Kohl’s is present in all states. Kohl’s Corp. owns and runs department stores that are good for families. It sells clothes, shoes, and accessories for women, men, and children.

Kohl’s is a leading omnichannel retailer with over 1,100 stores in 49 states. Kohl’s wants to give families the inspiration and tools they need to live happy, full lives. To do this, they offer amazing national and exclusive brands and great deals.

Difference between a MyKohlsCard and a MyKohlsCharge Card

The difference between a MyKohlsCard and a MyKohl’sCharge card primarily lies in their benefits and usage:

My Kohl’s Charge Card:

- Credit Card: The Kohl’s Charge card is a store credit card that can be used exclusively at Kohl’s stores and on their website.

- Benefits: It typically offers special discounts, promotions, and rewards points on purchases made at Kohl’s.

- Interest Rates: As a credit card, it comes with an interest rate if you carry a balance.

My Kohls Card:

- Rewards Program: MyKohl’s Card is part of Kohl’s rewards program, which is separate from the store’s credit card. It’s more about earning points and rewards for purchases rather than offering credit.

- Benefits: It provides perks such as earning Kohl’s Cash, discounts, and other promotional offers based on spending at Kohl’s.

- Usage: It doesn’t function as a credit card and can’t be used to make purchases on credit.

Essentially, the Kohl’s Charge card is a credit card for purchases at Kohl’s, while the MyKohl’s Card is a rewards card that helps you earn benefits and discounts.

Is the Kohl’s Credit Card Right for You?

If you regularly shop at Kohl’s and can pay off your balance in full each month, the Kohl’s Credit Card offers great rewards and discounts that make it a worthwhile option. However, if you’re not a frequent shopper at Kohl’s or plan to carry a balance, the high interest rates could outweigh the benefits.

Ultimately, whether the Kohl’s Credit Card is worth it depends on how well you can take advantage of the rewards while managing any potential fees.

How to use MyKohlsCard App

Using the My Kohl’s Card app is pretty straightforward! Here’s a quick guide to help you navigate it:

- Download the App: Install the My Kohl’s Card app from the App Store (iOS) or Google Play Store (Android).

- Log In/Create Account: Open the app and log in with your Kohl’s account or create a new one.

- Add Your Card: Link your Kohl’s Card by entering your card details.

- Check Balance & Rewards: View your card balance and any rewards on the home screen.

- Make Payments: Use the “Payments” section to pay your bill.

- Check Offers: Check for current promotions and coupons in the offers section.

- Shop Online: Browse and shop Kohl’s products directly in the app.

- Locate Stores: Use the store locator to find the nearest Kohl’s.

My Kohl’s Card eCustomer Service

You may access your credit limit, bill payments, and paperless statements from any location at any time with your Kohl’s Card account with the help of mykohlscard ecustomer service.

- Phone Number: Call 1-800-564-5740

- Any Order related questions – 1-855-564-5705

- Payment-related questions – 1-855-564-5748

- For Corporate Gift Cards only – 800-653-1774

- Timings:

- Monday – Saturday 7 am to 9 pm CST

- Sunday 8 am to 9 pm CST

- For Credit Card Payments and Correspondence: PO Box 2983 Milwaukee, WI 53201-2983, USA

- Kohl’s Corporate Office Address: Kohl’s Corporation, N56 W17000 Ridgewood Drive, Menomonee Falls, WI 53051, USA

- Website: www.mykohlscard.com